Two Bergen County Democrats have introduced legislation in the state Assembly to impose an additional 5 percent sales tax on guns and ammunition to go toward safety improvements at schools and other government buildings.

If the bill (A3727) becomes law, the full sales tax on guns and ammunition will rise to 12 percent from 7 percent.

"Since the incident in Newtown, you start to listen to people," said Assemblywoman Connie Wagner (D-Bergen), a co-sponsor of the measure with Assemblyman Tim Eustace. "I’m listening to students. I’m listening to educators. I’m listening to everybody. I think the first thing has to be to take care of our infrastructure. Then comes the second question: Well, how are we going to pay for this?"

If the bill (A3727) becomes law, the full sales tax on guns and ammunition will rise to 12 percent from 7 percent.

"Since the incident in Newtown, you start to listen to people," said Assemblywoman Connie Wagner (D-Bergen), a co-sponsor of the measure with Assemblyman Tim Eustace. "I’m listening to students. I’m listening to educators. I’m listening to everybody. I think the first thing has to be to take care of our infrastructure. Then comes the second question: Well, how are we going to pay for this?"

Under the terms of the measure, the money would go into a "safety tax fund" to pay for things like security cameras, electronic emergency notification systems, devices controlling entrances, panic buttons and doors that could be locked only from inside.

Although the bill defines a public building as anything from a school to a movie theater, Wagner said she plans to amend the bill so that it applies only to publicly owned buildings.

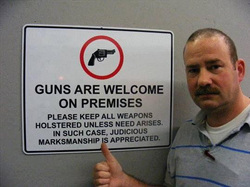

Wayne Viden, co-owner of Bob’s Little Sports Shop in Glassboro, balked at the proposed tax increase, saying gun buyers already pay a $15 fee plus sales tax for a background check.

In addition, Viden said, there were fees for identification cards for buyers of firearms as well as a handgun purchase permit.

"I think they just want to charge more money for guns to try to discourage people from buying them," he said. "There are so many useless taxes they have that they don’t use the money correctly for. What guarantee is there they’re going to use this correctly?"

Although the bill defines a public building as anything from a school to a movie theater, Wagner said she plans to amend the bill so that it applies only to publicly owned buildings.

Wayne Viden, co-owner of Bob’s Little Sports Shop in Glassboro, balked at the proposed tax increase, saying gun buyers already pay a $15 fee plus sales tax for a background check.

In addition, Viden said, there were fees for identification cards for buyers of firearms as well as a handgun purchase permit.

"I think they just want to charge more money for guns to try to discourage people from buying them," he said. "There are so many useless taxes they have that they don’t use the money correctly for. What guarantee is there they’re going to use this correctly?"

RSS Feed

RSS Feed